SAP stands for System Application Product in Data Processing, SAP is one of the world’s leading producers of software for the management of business processes, developing solutions that facilitate effective data processing and information flow across organisations.

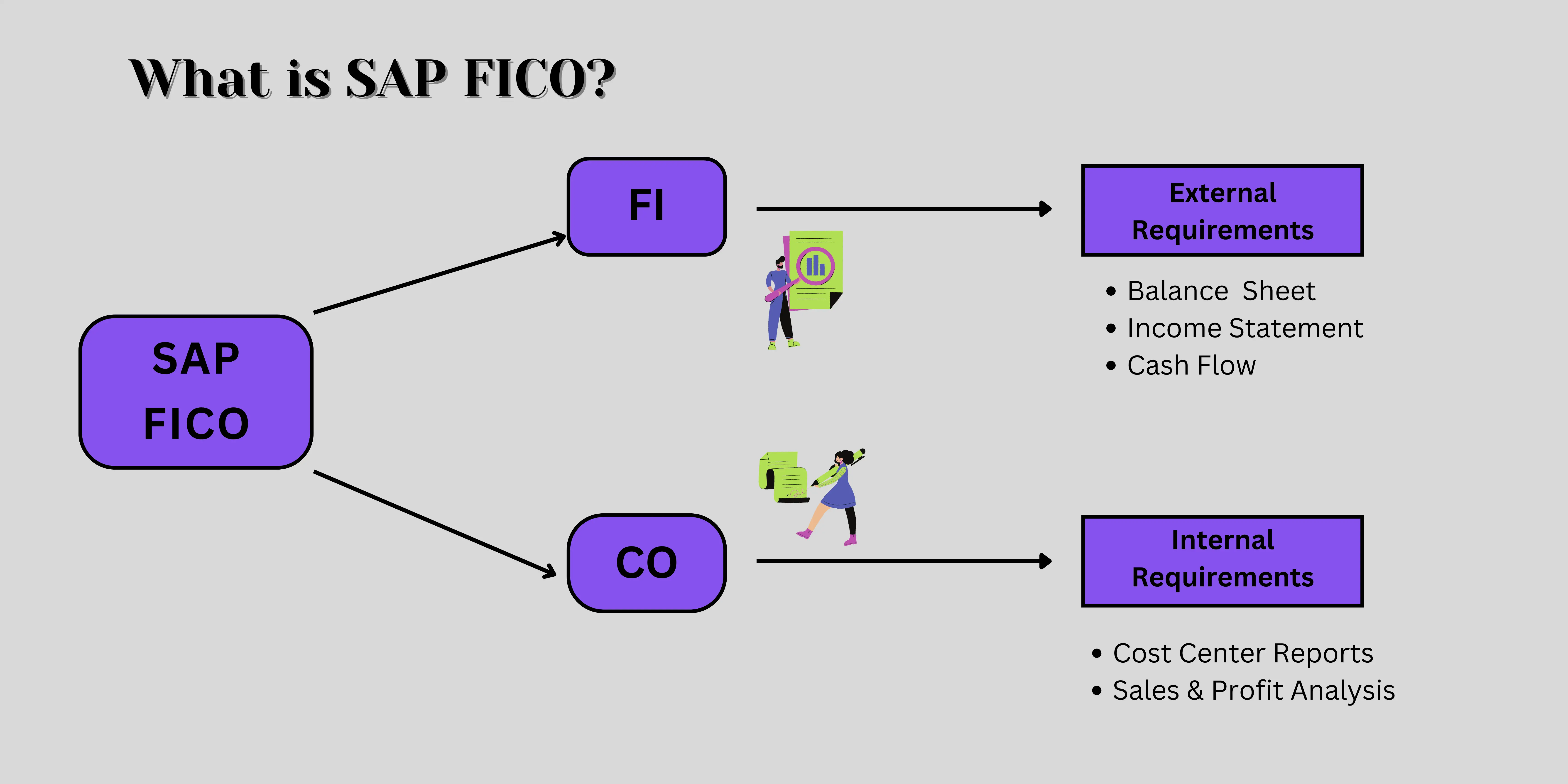

The full form of SAP FICO is Financial Accounting and Controlling. SAP FICO is one of the most popular modules used by organizations to manage their financial data. The module is used to record and manage financial transactions such as accounts payable, accounts receivable, general ledger, fixed assets, bank, and more. It helps to integrate and automate financial processes and provides key insights into an organization’s financial performance.

SAP FICO is often used in conjunction with other modules in SAP such as SAP Materials Management (MM) and SAP Production Planning (PP).

The SAP FICO (Financial Accounting and Controlling) course is a comprehensive course designed to teach students the basics of SAP FICO and how to use it to manage financial data. The course focuses on the configuration and management of the SAP FI-CO system and covers topics such as creating and maintaining master data, setting up and using the various financial document types, and understanding the various integration points between FI-CO and other SAP components. The course also covers important topics such as cost and profit centre accounting, asset accounting, and reporting.

SAP FICO (Financial Accounting and Controlling) is a module in SAP ERP that allows an organization to manage its financial data. It integrates with other SAP modules like Materials Management (MM), Sales and Distribution (SD), Production Planning (PP), and Project System (PS). It provides a complete financial solution for an organization by providing tools for financial planning, budgeting, accounting, and reporting. It also helps organizations to streamline their financial processes and make informed decisions.

The duration of an SAP FICO course can vary depending on the type of course and the provider. Generally, the duration is between 3-4 months.

In SAP FICO, the accounting for assets is done in the Asset Accounting (FI-AA) module. This module integrates with the Finance (FI) and Controlling (CO) modules.

It enables the tracking of all asset-related transactions, including the acquisition, retirement, depreciation, and transfer of assets. It also enables the tracking of asset values and the calculation of depreciation.

The Asset Accounting module is responsible for the calculation of depreciation, the posting of depreciation to General Ledger, and the maintenance of the asset master record. The asset master records contain information such as asset description, asset value, and depreciation rules.

You can visit our center & get in touch with our counsellors to know more about the SAP FICO course Fees. Schedule your visit here.

We have prepared a list of good SAP FICO Interview Questions that you should be ready for. These are some of the best interview questions which will make you think and prepare yourself for how to prepare for SAP FICO interview. TOP SAP FICO Interview Questions and Answers

DownloadIf you're looking for SAP FICO jobs, SAP FICO offer great pay and benefits, but they also have an excellent reputation for being able to train and develop their employees.

The best way to find SAP FICO jobs for freshers is by using LinkedIn's new Jobs for SAP FICO feature, which makes it easy for employers to post listings for open positions. SAP FICO is the most in-demand job title in the world, according to LinkedIn. You can also check out our list of SAP FICO job categories, which includes everything from "IT Development" to "Finance." You can search by keyword or narrow down your search by industry sector or location

Career opportunities are available in the following fields:

If you're looking at creating an SAP FICO resume for freshers because your last one didn't work out—or if you're just starting out in your career and want an easy way to make sure your resume stands out from all the other ones floating around—then this is the right article for you!

Enter your E-mail id to receive Brochure.

Want to know more about SAP fee structure? if yes then let us help you with that, fill a simple Enquiry form our expert counsellor will get in touch with you.

Enquire Now